Table of Contents

- Latest estimates and trends | Australian Taxation Office

- Individuals | Australian Taxation Office

- Individuals statistics | Australian Taxation Office

- Australian Income Tax Rates 2014 • Australia First Party

- Australian Income Tax Brackets and Rates

- Individuals statistics | Australian Taxation Office

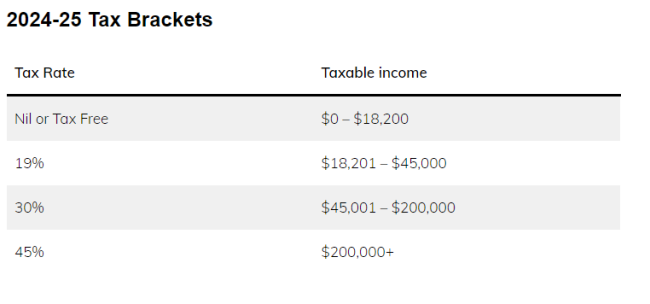

- Australian Income Tax Brackets & Rates (2024-2024)

- Federal Budget Personal Income Tax Measures - Carrick Aland

- Believe it or not…1 in 3 Australian households has net wealth of more ...

- First Glimpse at Tax Brackets in 2026 (And How Much More You’ll Have to ...

Understanding the Cost of Living

Key Highlights of Budget 2025-26

Impact on the Cost of Living

The Budget 2025-26 is likely to have a significant impact on the cost of living, with both positive and negative effects. Some of the potential implications include: Increased Affordability: Tax reforms and subsidies could lead to increased affordability for individuals and families, allowing them to allocate more resources to essential expenses. Reduced Financial Burden: Initiatives aimed at reducing the cost of healthcare and education could alleviate the financial burden on households, enabling them to allocate resources more efficiently. Regional Disparities: The budget's focus on infrastructure development and regional growth could exacerbate regional disparities, leading to varying costs of living across different areas. The Budget 2025-26 is poised to have a profound impact on the cost of living, with far-reaching consequences for individuals, families, and the broader economy. As the financial landscape continues to evolve, it's essential to stay informed about the key developments and their potential effects on your wallet. By understanding the changes introduced in the Budget 2025-26, you can make informed decisions about your finances and navigate the shifting cost of living with confidence.Stay tuned for further updates and analysis on the Budget 2025-26 and its implications for the cost of living. With careful planning and a deep understanding of the financial environment, you can thrive in the face of economic uncertainty.